Home

Movement for a Financial Literate Society

Financial Literacy – It reflects a serious discussion among government, private and public sector organizations deeply concerned about disturbing trends in the fiscal behavior of Average Americans. American’s can’t “do better” if the don’t “know better“. “Knowing better” does not of course in itself cure-all-ills related to poor fiscal behavior. But it is where we must begin.

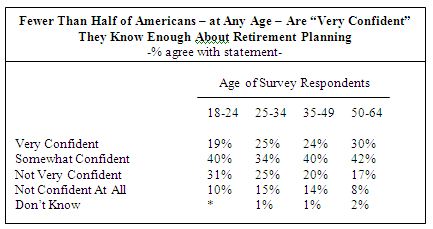

America needs a good shaking. A September 2005 study by the Bureau of Economic Analysis reported that the rate of personal savings as a percentage of disposable personal income had fallen to zero in June of that year. A 2005 study by the Employee Benefit Research Institute notes that most workers say they are behind in saving for retirement, and only 42% say they have even tried to figure out how much money they will actually need. A 2004 Roper Pole records less than 1-in-3 Americans ages 25-64 are “very confident” about their fiscal know-how. The following table from the Roper Pole shows just how un-confident most people feel about their financial-intelligent-quotient…

The Roper Pole shows that even at the age where Americans are likely to feel most confident about their financial competence (ages 50-64), at least 1-in-4 are “not very” to “not at all confident”, and a near additional 2-in-4 are only “somewhat confident”. The Roper Pole concludes: “Americans generally do not show great familiarity with a range of things that can impact their financial planning” (August 2004 Journal of Accountancy).

The need for a national financial literacy movement has never been greater.

Today:

- Consumers are faced with a wider and increasingly complicated array of options for managing their finances (Asset Allocation, Re-balancing, Dollar Cost Averaging, Efficient Frontiers, etc.);

- Technological advances have made a broad range of complicated investment choices increasingly available to average Americans;

- Workers have never been more responsible for managing their own retirement accounts; and, due to these advances.

- Consumers are more vulnerable to predatory lenders and other unscrupulous providers of financial services.

More then ever, a clear understanding of the world of money and investing, taxes and estate planning, Social Security, health, long term care and other insurances are necessary to manage our complex and fast paced financial environment.